Exploring The Benefits of

NexPath

Discover how NexPath can enhance after-tax returns through tax-loss harvesting, portfolio personalization, and tax-efficient transitions.

Learn how NexPath can enhance your after-tax returns and portfolio customization

Ready to see how NexPath could benefit your portfolio?

Complimentary analysis – No obligation required

Why NexPath Outperforms Traditional Options

Tax Efficiency

Enhanced after-tax returns through tax-loss harvesting and tax alpha generation

Portfolio Customization

70 levels of customization to align with personal values and investment goals

Tax-Efficient Transitions

Fund in-kind without creating taxable events, achieving transition alpha

Individual Security Ownership

Direct ownership of securities rather than fund shares for greater control

Risk Management

Minimize tracking error while maintaining benchmark exposure

Values-Based Investing

ESG screening and personalization options not available with traditional funds

NexPath vs Traditional Options

See how NexPath provides unique advantages over mutual funds and ETFs

| Potential Benefits | Mutual Funds | ETFs | NexPath |

|---|---|---|---|

| Seeks to match (or exceed) the returns of a benchmark index | |||

| Ability to fully replicate index constituents | |||

| Tax efficiency | |||

| Potential to create tax alpha | |||

| Potential to create transition alpha | |||

| Portfolio customization | |||

| Ability to fund in-kind |

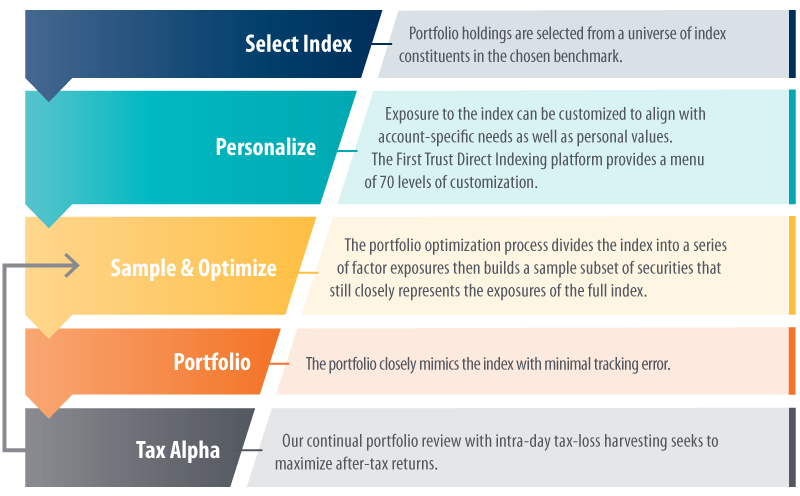

The NexPath Investment Process

A systematic approach to building a customized, tax-efficient portfolio that tracks your chosen benchmark

Ready to Optimize Your After-Tax Returns?

Complimentary analysis • No obligation • Expert portfolio optimization

Get Your Personalized Portfolio Analysis

Schedule a complimentary consultation to discover how NexPath could optimize your portfolio’s after-tax returns.

Portfolio Optimization Analysis

Detailed review of how NexPath could enhance your returns

Tax Alpha Assessment

Calculate potential tax savings vs. traditional funds and ETFs

No Obligation Required

Professional analysis with no pressure to engage further

Schedule Your Portfolio Stress Test

By submitting, you agree to our Terms of Service and Privacy Policy