Understanding Covered Calls: Generate Income From Your Stock Holdings

What Is A Covered Call?

A covered call is a two-part strategy: you own shares of a stock and sell (write) a call option on those same shares. The “covered” part means you already own the stock, protecting you if the option is exercised.

When you sell a call option, you give someone else the right to buy your shares at a specific price (strike price) by a certain date. In exchange, you receive immediate cash called the premium.

One call option contract represents 100 shares. To sell a covered call, you need to own at least 100 shares of the underlying stock.

Three Possible Outcomes

Stock Stays Flat or Falls

Stock price stays below the strike price at expiration.

What Happens:

- Option expires worthless

- You keep your shares

- You keep the premium

- You can repeat the strategy

Stock Rises Moderately

Stock rises but stays below or at the strike price.

What Happens:

- Option expires worthless

- You keep your shares

- You keep the premium

- You enjoy stock price gains

Best Case Scenario

Stock Rises Significantly

Stock rises above the strike price at expiration.

What Happens:

- Shares get "called away"

- You sell at strike price

- You keep the premium

- Miss gains above strike

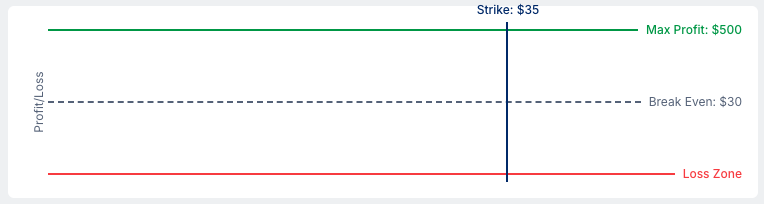

Real-World Example

- Initial Setup

| Stock Owned | 100 shares of XYZ |

| Current Stock Price | $32.00 per share |

| Call Strike Price | $35.00 |

| Expiration | 30 days |

| Premium Received | $200 |

Possible Outcomes at Expiration

If stock at $30:

Stock loss: -$200 | Premium: +$200

Net: $0 (break even)

If stock at $34:

Stock gain: +$200 | Premium: +$200

Net: +$400 profit

If stock at $40:

Shares sold at $35: +$300 | Premium: +$200

Net: +$500 (but missed $500 above strike)

Profit/Loss Diagram

Benefits & Considerations

Benefits

Generate Income

Collect premium immediately, regardless of what happens

Downside Protection

Premium provides a small cushion against losses

Repeatable Strategy

Can be executed monthly or quarterly for consistent income

Lower Risk

Considered one of the safest options strategies

Considerations

Limited Upside

You cap your potential gains at the strike price

Shares May Be Called Away

If stock rises above strike, you must sell your shares

Doesn't Prevent Losses

Premium only partially offsets a significant decline

Market Timing

Works best in flat or slowly rising markets