Advanced Portfolio Strategy

NexPath Custom Indexing

Advanced Portfolio Strategy

NexPath Custom Indexing

<0.5%

Average Tracking Error

70+

Customization Levels

0.5-2.0%

Tax Alpha Potential

$250K

Minimum Investment

Why NexPath Outperforms Traditional Investment Options

Direct indexing provides unique advantages that mutual funds and ETFs simply cannot match, delivering superior after-tax returns and unprecedented customization.

Enhanced Tax Efficiency

Direct indexing allows for daily tax-loss harvesting, potentially generating significant tax alpha compared to traditional funds.

Unparalleled Customization

70 levels of customization allow you to align investments with personal values and specific objectives.

Seamless Transitions

Fund in-kind transfers eliminate taxable events when transitioning from existing portfolios.

Precision Tracking

Advanced optimization ensures minimal tracking error while maximizing customization benefits.

Individual Ownership

Own individual securities directly rather than fund shares, providing greater control and transparency.

Quantified Alpha Generation

Measurable tax alpha through systematic loss harvesting and transition strategies.

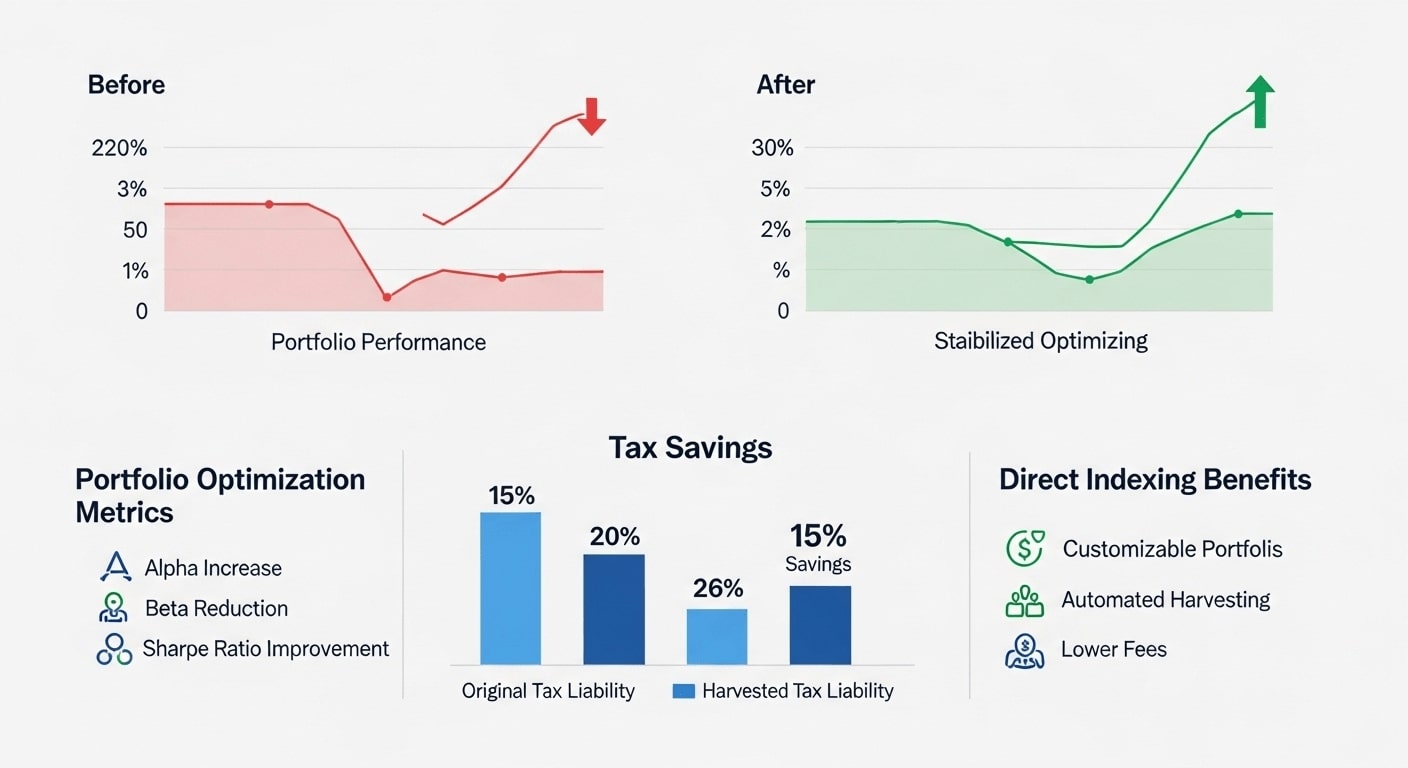

Advanced Tax-Loss Harvesting in Action

Daily Loss Monitoring

Continuous surveillance identifies harvesting opportunities across all holdings

Immediate Reinvestment

Maintains market exposure while capturing losses through similar security purchases

Wash Sale Avoidance

Sophisticated algorithms ensure compliance while maximizing harvest benefits

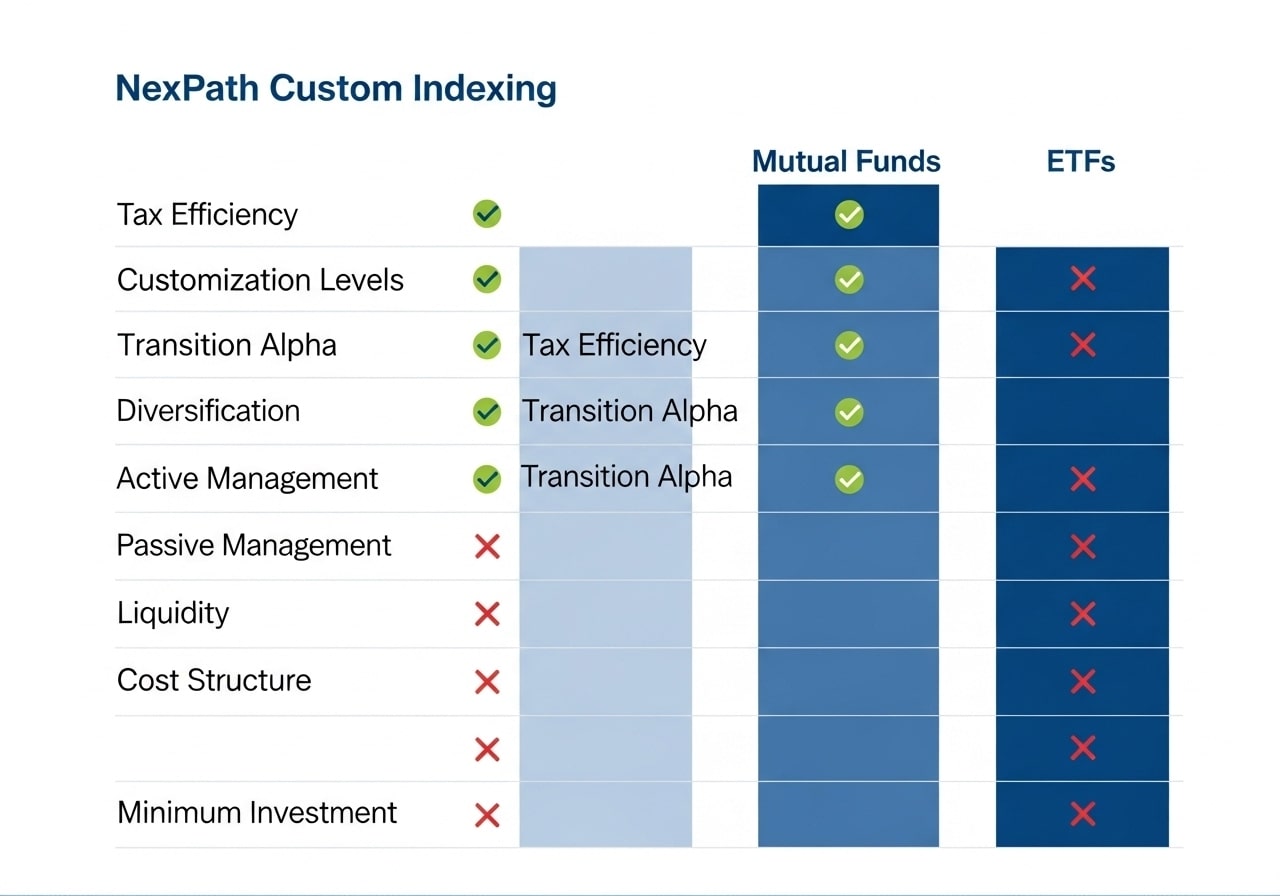

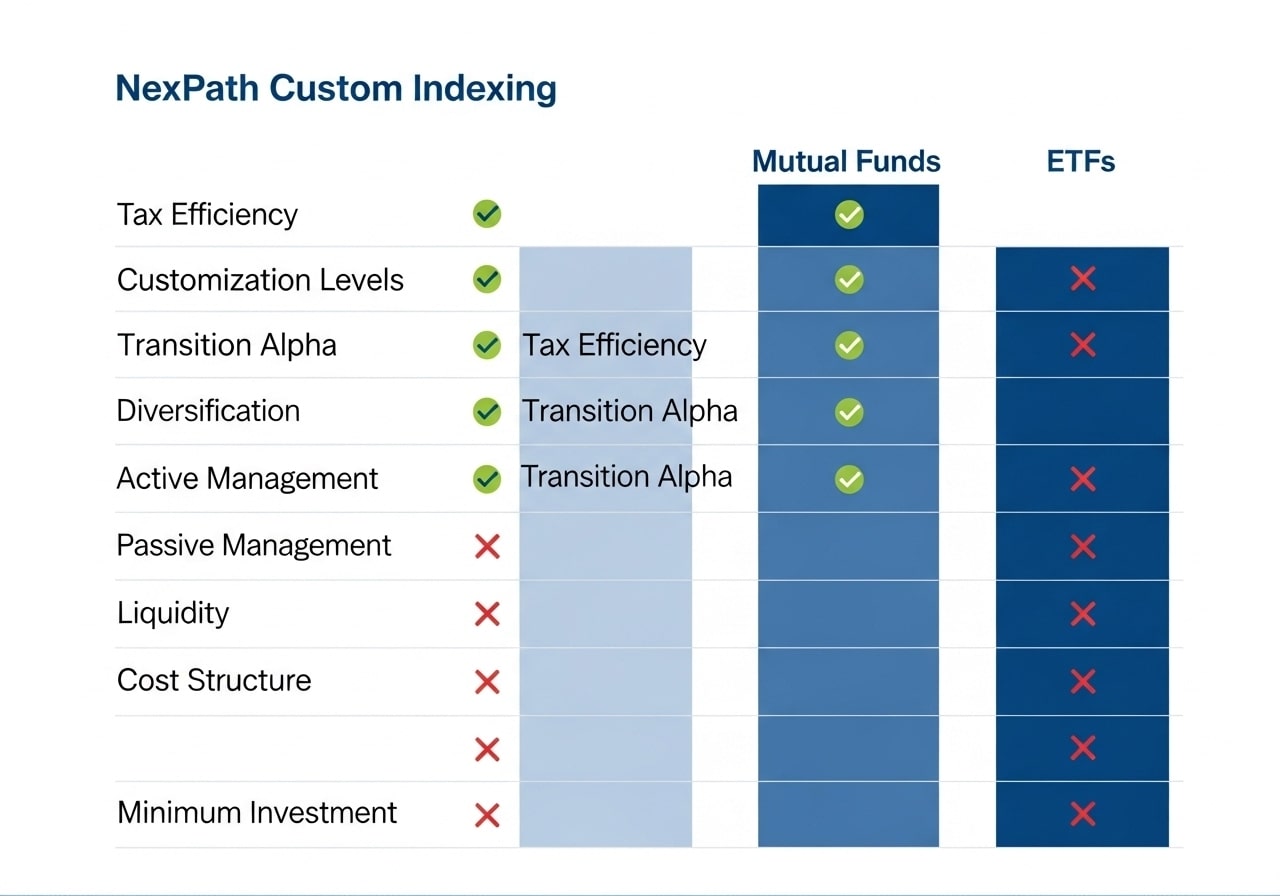

NexPath vs Traditional Options

Feature Comparison

| Potential Benefits | Mutual Funds | ETFs | NexPath |

|---|---|---|---|

| Seeks to match benchmark returns | |||

| Ability to fully replicate index constituents | |||

| Tax efficiency through loss harvesting | |||

| Potential to create tax alpha | |||

| Potential to create transition alpha | |||

| Portfolio customization options | |||

| Ability to fund in-kind | |||

| Individual security ownership |

Feature Comparison

| Potential Benefits | Mutual Funds | ETFs | NexPath |

|---|---|---|---|

| Seeks to match benchmark returns | |||

| Ability to fully replicate index constituents | |||

| Tax efficiency through loss harvesting | |||

| Potential to create tax alpha | |||

| Potential to create transition alpha | |||

| Portfolio customization options | |||

| Ability to fund in-kind | |||

| Individual security ownership |

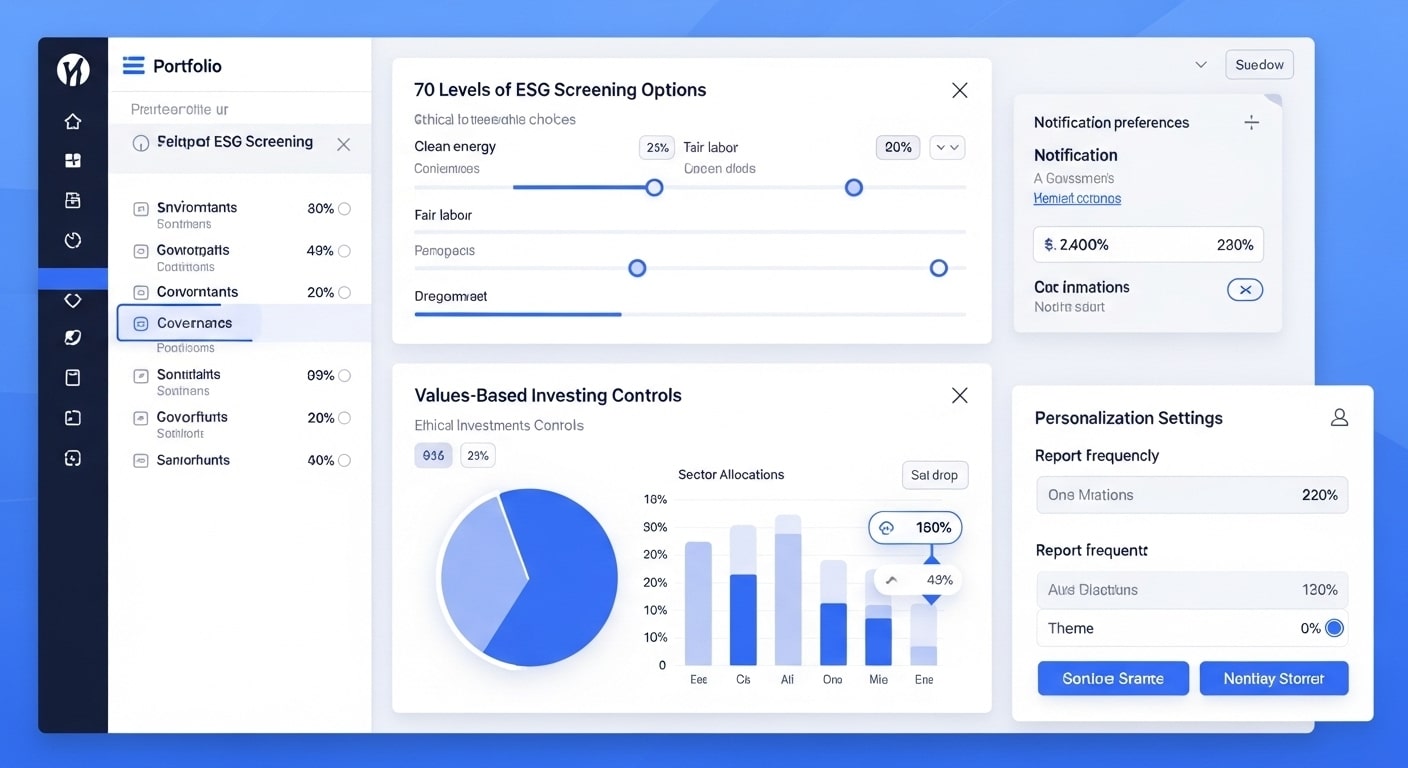

Unprecedented Portfolio Personalization

ESG & Values-Based Screening

Exclude companies based on environmental, social, and governance criteria or personal values

Sector & Geographic Tilts

Overweight or underweight specific sectors, countries, or regions while maintaining diversification

Risk Management Overlays

Implement additional risk controls, volatility targets, or factor exposures

Tax Optimization Preferences

Configure harvesting aggressiveness, holding periods, and loss recognition strategies

The NexPath Investment Process

Index Selection & Analysis

Personalization Configuration

Portfolio Optimization

Implementation & Funding

Ongoing Management

Ready to Transform Your Portfolio Strategy?

Discover how NexPath Custom Indexing can enhance your after-tax returns through advanced tax optimization and unprecedented personalization.